The debt to income ratio or LTV is something that the bank reviews when processing your mortgage application.

The extra payments have to be paid towards the principal balance instead of the next month's interest payment. The payoff time with extra payment is a little over 7 years.īefore you start to make extra payments, make sure you talk to the bank first. The total interest payments with extra payments are $6,316.11 The monthly payment with extra payment is $425.58 He would pay off the loan in a little over 7 years, and the total interest payments will be reduced to only $6,316.11. If the borrower increases his monthly payment by $100, which is the extra payment. The total interest payments are $9,069.46 Let's look at our previous example, where a borrower has a $30,000 loan with a 5.5% interest rate and a 10-year term. They can save thousands of dollars in interest payments depending on the size of the loan and the number of extra payments that you make. Extra payments allow borrowers to pay off their student loans faster and earlier.

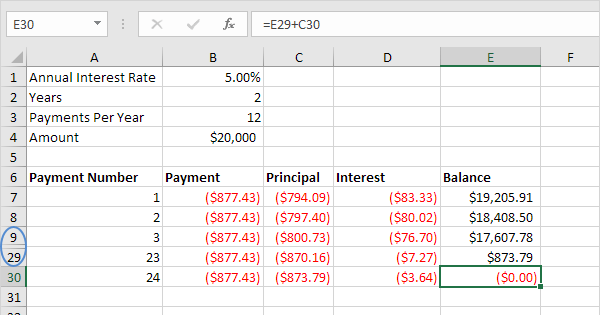

One way to pay off student loans faster is to make extra payments. The longer the term, the more costly it gets as the borrower would pay more in interest payment. Therefore, you may want to pay off your student loan faster.Ī typical student loan can last anywhere from 10 to 25 years. The longer the term or the interest rate, the most costly it gets. The interest payment is almost one-third of the amount borrowed. The monthly payment would be $325.58, and the total interest cost would be $9,069.46 after 10 years of payment. The costs of a student loan depend on 3 variables, the size of the loan, the interest rate, and the terms.įor example, if a student borrowed $30,000 with an interest rate of 5.5 with a 10-year term.

0 kommentar(er)

0 kommentar(er)